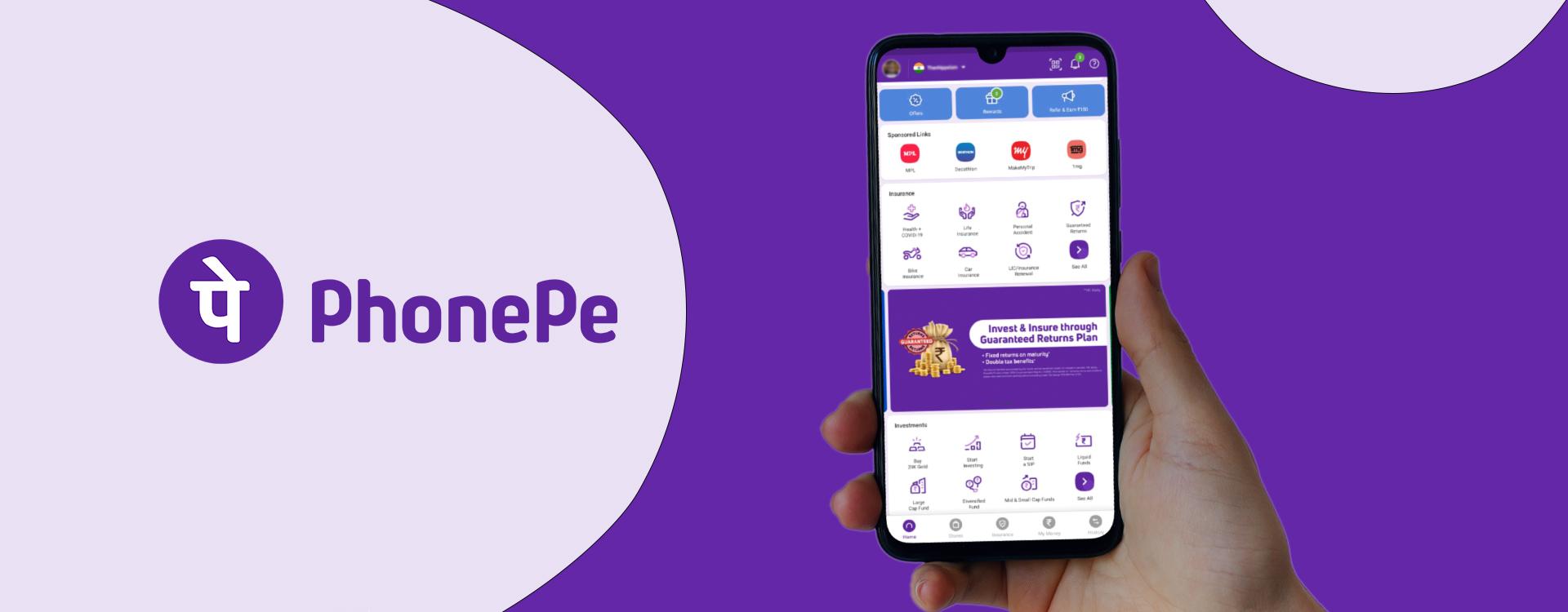

In this thread, I’m going to compare PhonePe and Google Pay and which one you choose between these two best UPI Payment Apps. Stay tuned till the end to know in detail. Google Pay and PhonePe let users send and receive money but also pay utility bills, recharge metro cards, book tickets for the train, flight, and movies through these apps. With the increase of digital transactions in day-to-day life, it comes as no surprise that big brands, as well as startups, are working on digital payment applications and mobile wallets. Let’s start PhonePe vs Google Pay – Which Should you Opt for?

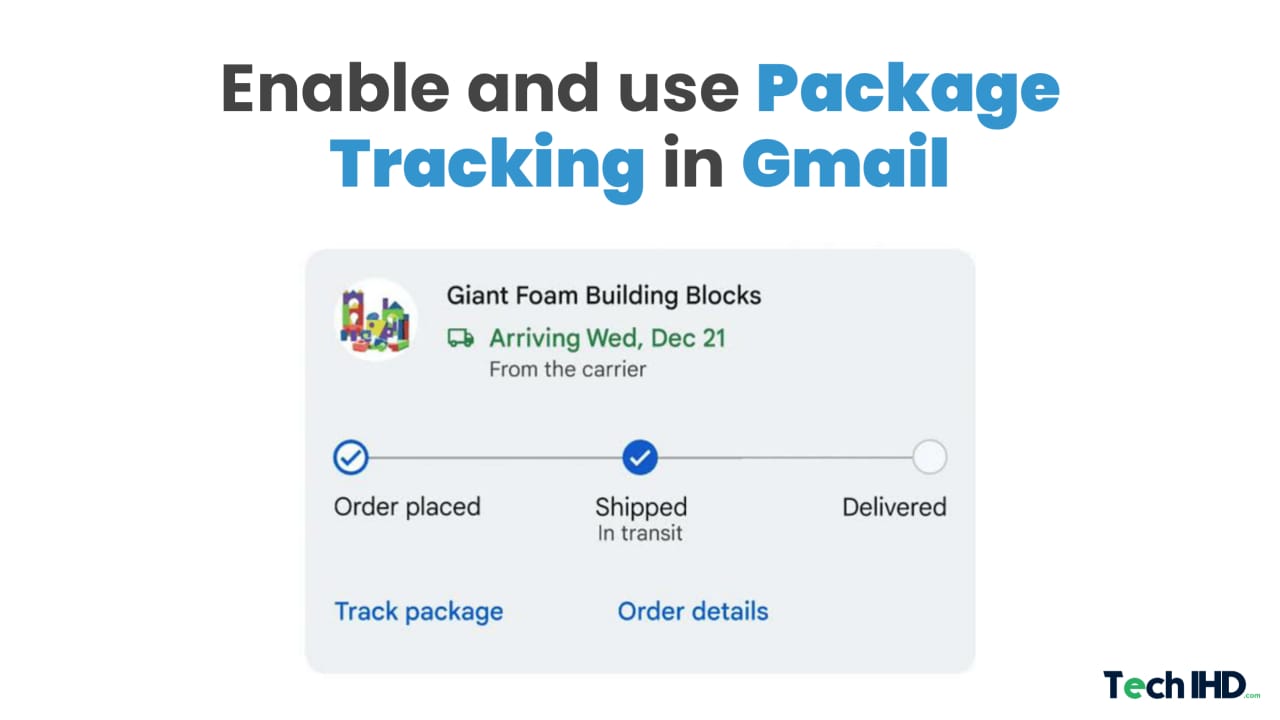

App Preview: PhonePe – UPI, Recharges, Investments & Insurance

Download: Google Play Store

Size: 40M

App Preview: Google Pay: A safe & helpful way to manage money

Download: Google Play Store

Download: Google Play Store

Size: 69M

PhonePe vs Google Pay: Introduction

PhonePe: PhonePe is a payments app that allows you to use BHIM UPI, your credit card and debit card or wallet to recharge your mobile phone, pay all your utility bills and also make instant payments at your favourite offline and online stores. You can also invest in mutual funds and buy insurance products on PhonePe.

Google Pay: Google Pay is a safe, simple, and helpful way to manage your money, giving you a clearer picture of your spending and savings as You can pay at your favorite place, Send and receive money instantly, Earn rewards for everyday payments and Understand your spending & improve your financial health.

PhonePe vs Google Pay: User Interface

Let’s talk about the interface of both PhonePe and GooglePay.

◼️ PhonePe: Phonepe home page is more clear. In Phonepe, all icons have much spacious. Phonepe home page icons are a little bigger and better than in Google Pay. So, you can easily get your icon. Because of clarity and bigger fonts in Phonepe, you can easily access the required icon.

◼️ Google Pay: Google Pay app shows your contacts and bills that you can pay, the overall interface isn’t as well-categorized as PhonePe and can be hard for a first-time user to get hang of it.

When it comes to interface, you can’t go wrong with either one. Both PhonePe and Google Pay are easy to use and have a clean and intuitive interface but still, if you ask me then I will choose PhonePe.

PhonePe vs Google Pay: Features

◼️ Features Of PhonePe

1. It is easy to recharge your Mobile and DTH connection.

2. Users can transfer money using BHIM UPI.

3. You can pay your credit card bills and also pay your utility bills.

4. Users can use their favorite travel, food, grocery, and shopping apps on ‘PhonePe’ without downloading them.

5. You can also invest in Tax saving funds.

6. Pay at offline stores and shops.

7. Transaction Limit: 10000 for wallet and 1L for UPI

8. You would get rewards and cashback offers on every transaction you are going to make. Phone Pe is giving more cashback amounts.

9. PhonePe app is a single app which is providing different other services in its platform as well. Through the SWITCH option, you can access your favourite app and services with just a few clicks.

◼️ Features Of Google Pay

1. Quick and secure way to transfer and receive money.

2. Users can take the help of Google Pay for paying their utility bills like gas, water, and many others.

3. Google pay offers several rewards and cashback benefits to the users.

4. If you are suffering from financial problems, then you can take a loan by using Google Pay.

5. This app can be used for business purposes. The integration is straightforward, and there is no need for any fee.

6. Utilities: UPI payments, Bill payments- phone, DTH service, gas, ticket booking- train, bus, flight, etc.

7. Transaction Limit: More than 1L

PhonePe vs Google Pay: Pros & Cons

◼️ Pros of PhonePe

1. Send and Receive Money

2. Single app for many services

3. Wallet Top Ups

◼️ Cons of PhonePe

1. Sometimes money deducts from the sender but not received in the receiver’s bank.

◼️ Pros of Google Pay

1. Easy to set up and use

2. High level of security

3. Attractive promotion and reward programs

◼️ Cons of Google Pay

1. Sometimes money deducts from the sender but not received in the receiver’s bank.

PhonePe vs Google Pay: Verdict

According to my comparison, you can see that somewhere PhonePe is better while in some cases, GooglePay is better to use. Overall, PhonePe is the superior service. In the end, I would like to suggest PhonePe to everyone due to its secure and easy interface for the users also it is having more services than GooglePay. You can use it for sending and receiving money from your family members or friends. If you haven’t used this app, then you should download it right now. Do share your thoughts on this mobile payment battle between Google Pay and PhonePe in the comments below. That’s all!

So if you’re still confused regarding which one to go with, test them out both first to see which one you like better.

Image Credit: All the images shown here are a collection of screenshots taken on my device but all the rights are reserved to their original creators and Google Play Store.

Also Read: Vivo X60 Series With 120Hz Display Launched in India: Price, Specifications

TechIHD is now on Telegram. Click here to join our channel (@TechIHD) and stay updated with the latest headlines.