Digital payments have shown their true benefit when the whole world faced the deadliest virus and believing in such innovation, a number of startups entered the digital revolution to make the payments cashless.

And concerning the fact, a Bangalore situated UK-based startup called ‘MoneyHop‘ made the users feel about the true meaning of paperless transactions. The all-in-one digital banking solution ‘MoneyHop’ is a neobank regulated by RBI licensed bank, which aims to provide mobile banking services to Millenials throughout the country.

The neobank has recently raised $1.25 million in a seed round to provide seamless and cost-effective cross-border payments and remittance solutions for individuals and businesses in India.

The platform showcase a multi-currency bank account with the fusion of both credit+debit card, where the user can make payment in USD, INR, AUD with payment methods like UPI, QR, etc

Just like a physical bank account, the banking solution has integrated each and every feature/service within the mobile application, so as to avoid branch walks.

So if you’re an Indian citizen aged above eighteen and looking for a smart mobile international banking experience, then I guess MoneyHop should be the first and last choice. Here we go…

Key Features :

- A multi-currency bank account

- One Global Card which is a Fusion of Debit + Credit + FX cards

- Omni-channel spending ability

- Get the best interest rates – up to 6%

- Transfer money internationally or domestically at any time and from anywhere

- International transfers at 0% markup

- No hidden fees (100%transparency)

- Track and manage your expenses

- Earn rewards and cashbacks

How To Apply for MoneyHop Card?

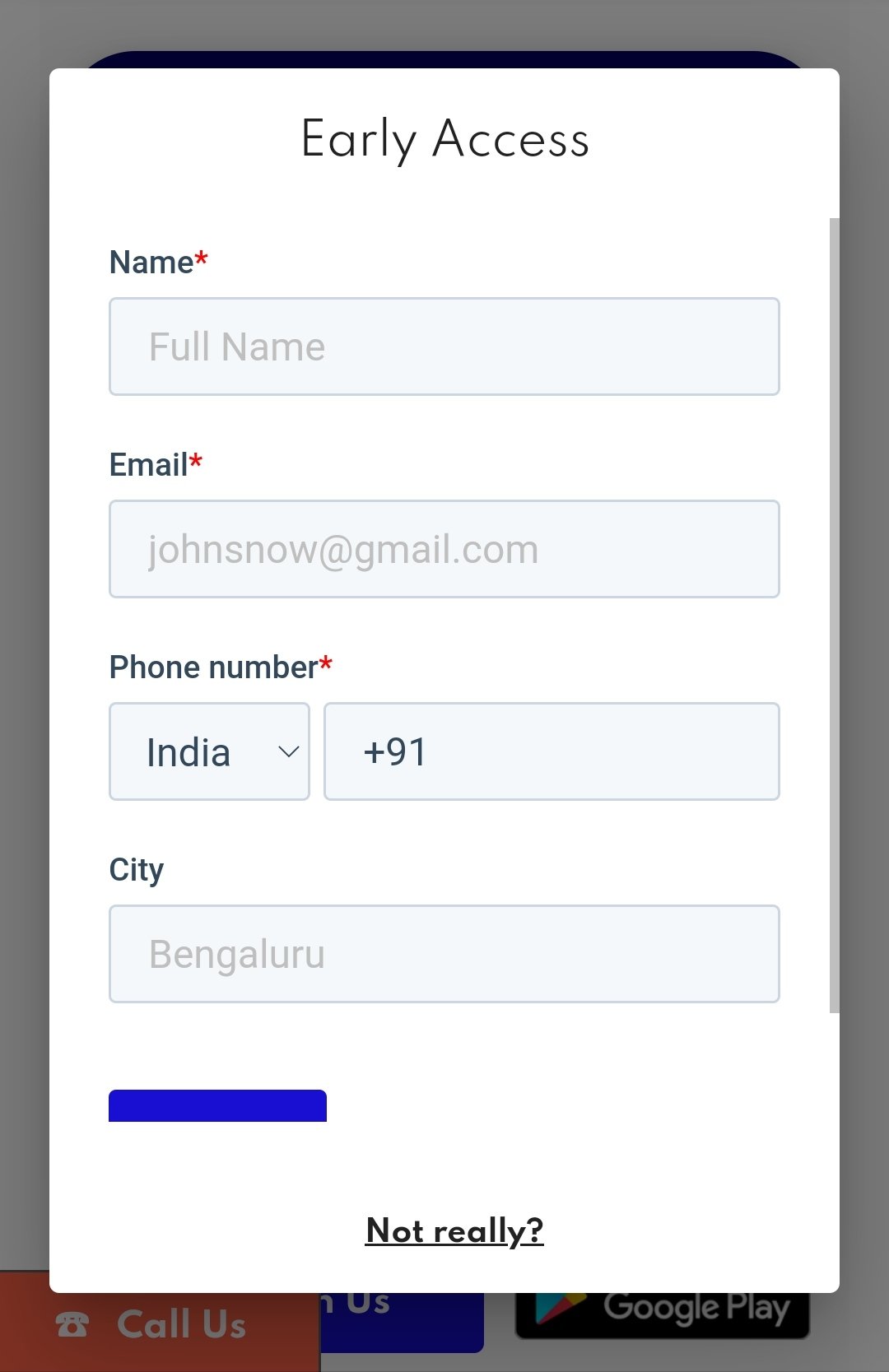

- Open moneyHop website

- Click on the Early access option, at the top right corner

- Now enter your full name, email address, phone number & your city

- Hit the submit to proceed

- Verify your email address & you will be successfully added to the joining waitlist

- As soon as you clear the waitlist, you will be reminded of your account status & will be able to use the moneyHop mobile application

- Done!

Also Read: Guide: How To Apply For YPay Card?

How To Complete KYC Verification?

- After getting a spot over the waitlist, you need to login into the moneyHop application

- At KYC verification, submit your Aadhar card no. & PAN card no. along with both side images

- Get the Aadhar verified via entering OTP, and your digital KYC will get completed

- Done!

Also Read: How To Apply For Walrus Card?

How To Order MoneyHop Physical Card?

- After successful KYC verification, a virtual moneyHop card is issued instantly.

- To get the physical card, visit the Cards section & click Order Now option

- Enter your shipping address & complete the payment via any payment method

- Done! your physical hop card will be reached to you within the given delivery time

Also Read: How to Apply for Omni Card?

Final Words

The Gen Z of this smartphone era is more into digital activities than physical. And for them, having a full-fledged digital bank account is more comfortable than a physical one where paperwork is required to initiate any banking service.

However, the fintech startups helped the upcoming generation to fully rely on mobile-based banking and the move has been turned beneficial for every smartphone user.

Similarly, startup-like MoneyHop is being preferred for its smooth digital banking solutions & if you’re one of the smartphone users who prefers online payments to atm withdrawals, then go with MoneyHop to feel a unique digital banking experience.